Hungary’s power market has recently witnessed an unprecedented development: by the end of August 2025, the country had already recorded more hours of zero and negative electricity prices than during the whole of 2024. While this trend signals challenges in balancing supply and demand, it also underlines the growing impact of renewable generation and the urgent need for modern grid solutions.

According to data from the Ministry of Energy, the number of hours with prices at or below zero reached a historic peak by late summer. This sharp increase is primarily linked to the rapid expansion of solar capacity. On 1 July 2025, Hungarian solar plants achieved a production record of 6,361 MW, briefly covering more than 90% of domestic demand (source: MNNSZ).

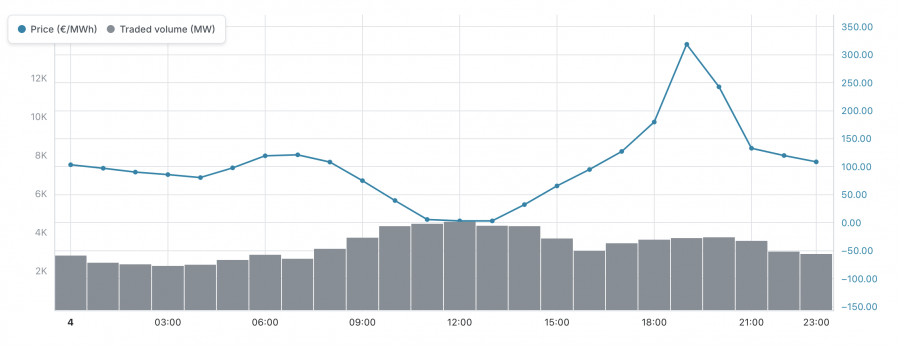

The outcome of this surge was a volatile wholesale market. Intraday prices fluctuated from –41 EUR/MWh to more than 640 EUR/MWh within the same day. Such extremes highlight the structural imbalances of a system increasingly reliant on variable renewables without sufficient flexibility. In fact, Hungary recorded more zero/negative electricity price hours in 2025 (by August) than in all of 2024, demonstrating the scale of these imbalances.

It is important to note that Hungary is not an isolated case. Across Europe, countries have faced thousands of hours of negative electricity prices in 2024 and 2025. Spain alone registered more than 500 hours of such pricing this year, while Germany, France, and the Netherlands also reported significant increases. This shows that the challenge is systemic, highlighting the need for coordinated responses at both national and regional levels (source: Portfolio).

One of the most effective tools to address these fluctuations is energy storage. In Soroksár, E.ON recently commissioned a 5.5 MWh / 2.5 MW lithium-iron-phosphate (LFP) battery system. This installation enables grid operators to absorb excess solar output during low-demand hours and release it later, thereby stabilising prices and enhancing security of supply.

Beyond isolated projects, Hungary is beginning to integrate more storage and flexible capacity into its grid. According to experts, further investments in smart grids, demand response, and cross-border interconnections will also be essential (source: MNNSZ).

The Hungarian electricity market is undergoing a rapid transformation. On the one hand, negative prices reflect the success of renewable energy integration, but on the other, they expose the lack of flexibility mechanisms. Developing large-scale energy storage, improving market design, and enhancing regional cooperation are all necessary steps for a more resilient system.

Prices swinging from –41 EUR/MWh to 640 EUR/MWh clearly illustrate these imbalances, while solar generation records of 6,361 MW highlight the potential of renewables. Projects like E.ON’s Soroksár storage system demonstrate how energy storage is central to stabilising the grid and smoothing volatility. Moreover, this phenomenon reflects a broader European trend, reinforcing the urgency of coordinated solutions across countries.For a closer look at trading dynamics, you can explore the official HUPX aggregated trading data (visualised on our platform with zero-price units), which illustrates how often negative prices occur and under what conditions.